Location – Kevin B’s home

Welcome

Approve minutes from January 22, 2024 Board Meeting

Financial Report

- Billing process – response rate/ delinquent – Tom

- Checkbook vs. Financial summary document – Bill & Tom

Old Business

- Delinquent payments.

- Lien review update – questions to attorney

- Next steps

New Business

-

- Blow off valve at lower Riebli in new casing – has lid

- Glatfelter Insurance exclusion

- Kim Jackson (see below)

Continuing Business

- Website update – Susan Kullmann

- New Homeowners *1

- Communication to Homeowners – no broadcast messages this period

- Policies and procedures – pending WTA

- Generator maintenance – Yearly check 3/7 – passed w/ 2-hour load test

- SWRCB – supply vs. storage – no change

Priorities

- Meters/ Drought Conservation – Update on software, remaining units installed

- Billing agency – Kim Jackson/ KJ Bookkeeping

- Can bill ($65 per hour) to 20 hours per quarter and remain in budget

- QuickBooks purchase/ KJ?

- Full bookkeeping role? Billing – check writing – statements – prep for audit

- Name – Administrator, Bookkeeper?

- RMWC Treasurer roll– Bookkeeper oversite, monthly audit (receives bank statement)

- If approved, need to meet and roll out timeline (schedule) – letter to homeowners

- Credit Card payment? – roll up fee in tiered structure? Late charge change?

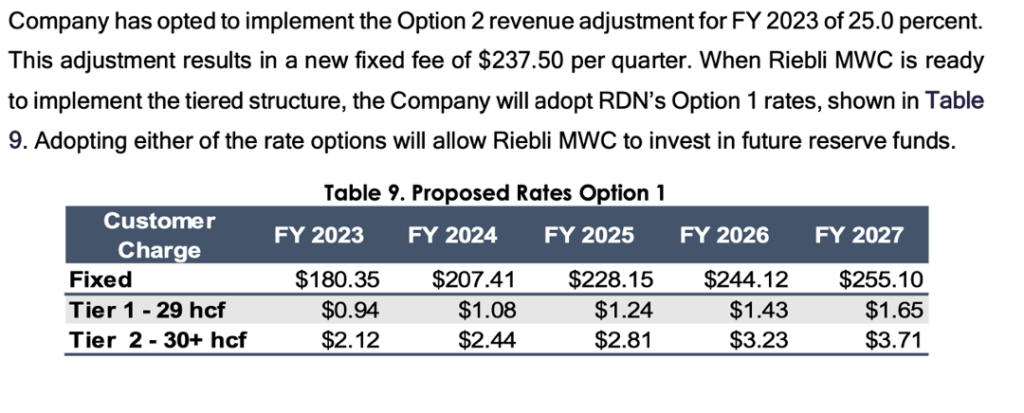

- Rate Structure roll out

- Which quarter? *2

- 2q (calendar) trial (parallel with KJ) rollout to neighbors?

- 3q (cal) roll out

- SWRCB drought measures – ntr

- Capital Planning and System Analysis (full system) ntr

Motions to approve:

- Retain Kim Jackson for bookkeeping role

Next Meeting/Location

1

* New owners at 4187 Bayberry Dr, (Kat’s place): Matthew & Elyse McDonald

* New owners for 2240 Riebli Rd. – Shawn & Charlotte Lantz

2

3

Delinquent Assessments and Late Charges. The due dates for all Assessments shall be established by the Board. Any Assessment shall be delinquent if not paid within fifteen (60) days of becoming due. Late charges in the amount of five percent (5%) of the delinquent Assessment shall be charged on all delinquent Assessments.

EG – 3rd quarter (fiscal) invoice goes out March 16, 2024

Due on March 31

Delinquent on May 31 – 231.80 + 11.59 = 243.39

Lien (now)

Lien placed April 30 + 10% or 23.18